Banco Santander knew about the possible intervention of Banco Popular before the capital increase

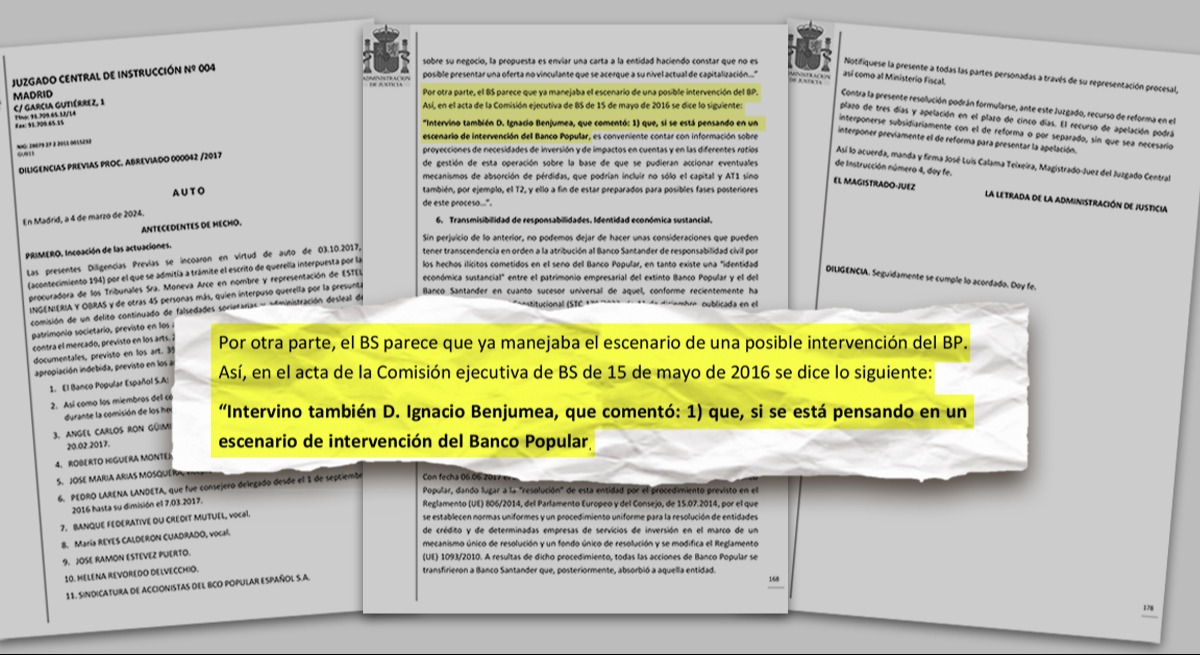

The top management of Banco Santander was already considering the scenario of a possible intervention of Banco Popular since May 2016, even before the board of directors of the latter entity had approved the capital increase that took place that same year, and more than fourteen months before the resolution occurred. This is stated by Judge José Luis Calama Teixeira in the ruling that concludes the investigative phase of the Popular case and will bring to trial the former president of the entity, Ángel Ron, the auditor PwC, and 12 other executives.

Specifically, according to the information from the minutes of the Executive Committee of Banco Santander on May 16, 2016, which is included in the ruling, Ignacio Benjumea, then an executive director of the entity, mentioned during the meeting of that day that “if we are thinking of a scenario of Banco Popular’s intervention…”. Additionally, in the same intervention, he stated that it would be advisable to have additional information regarding projections of investment needs, impacts on accounts, and ratios in order to be prepared for possible later stages of this process.

The move before the capital increase approval

This move took place before Popular’s own board meeting to give the green light to the capital increase in the entity for 2.5 billion on May 25, 2016. On that same day, a few hours before that action, the audit committee of this body had decided to bring the so-called ‘Operation SKY’ to the bank’s highest body. It is true that on April 11 of that same year, the shareholders’ meeting of Popular had approved for the board to make capital increase moves, but through a standard procedure and without revealing any specific intention. The capital increase was announced to the market through the National Securities Market Commission (CNMV) on May 26, 2016, ten days after the possibility of Popular’s intervention was mentioned in the Executive Committee.

In addition, and according to the documentation attached in the same ruling, Santander, along with other entities such as Bankia, Sabadell, and CaixaBank, accessed the data room where Popular’s figures were transferred until early May 2017, almost a year after the aforementioned meeting at the Cantabrian entity.

One step closer to trial

The judge’s ruling on the Popular case made public last Monday, which includes an excerpt from this minutes, marks the end of the investigative phase and proposes to prosecute Ángel Ron and PwC for alleged fraud in the 2016 capital increase, as well as for accounting fraud. The list of people who will face the judge also includes twelve other executives. On the other hand, excluded from the list are the former president of Banco Popular, Emilio Saracho, and another 20 individuals under investigation due to lack of evidence. The judge keeps Banco Santander’s possible civil liability on hold.

Intervención del Banco Popular por parte de Santander en 2016

En el año 2016, Santander manejaba la posibilidad de que el Banco Popular fuese intervenido antes de llevar a cabo una ampliación de capital. Esta decisión estratégica fue tomada con anticipación, considerando diversos escenarios y su impacto en el mercado financiero.

Implicaciones de la intervención en el Banco Popular

La intervención del Banco Popular por parte de Santander tuvo importantes repercusiones en el sector bancario y en la percepción de los inversores. La actuación de Santander en este episodio demostró su capacidad para anticiparse a situaciones de crisis y tomar medidas rápidas y efectivas para proteger sus intereses y los del mercado en general.

Acciones estratégicas de Santander en el sector financiero

La intervención del Banco Popular por parte de Santander es un ejemplo de las acciones estratégicas que las entidades financieras pueden llevar a cabo en momentos de incertidumbre. La capacidad de prever escenarios adversos y actuar con decisión y rapidez son cualidades clave para mantener la estabilidad y la confianza en el sistema bancario.

El sector financiero está en constante evolución y enfrenta diversos desafíos, por lo que la capacidad de adaptación y la anticipación son fundamentales para garantizar su solidez y sostenibilidad a largo plazo. La intervención del Banco Popular por parte de Santander es un claro ejemplo de cómo una entidad puede gestionar de manera eficaz una situación de crisis y proteger sus intereses y los de sus clientes.